Premium Charge

Determination of Premium Charge and Premium Charge Rate

JSF procures stocks, of which stock lending balance exceed money lending balance, by accepting stock lending applications on the day following the date of LMTs application (stock procurement through bidding).

JSF adopts applications from lower bidding rate and faster bidding time when the rate is the same, and determines Premium Charge at the highest bidding rate among adopted applications. JSF announces Premium Charge multiplied by lending term (number of days) as Premium Charge Rate.

JSF adopts applications from lower bidding rate and faster bidding time when the rate is the same, and determines Premium Charge at the highest bidding rate among adopted applications. JSF announces Premium Charge multiplied by lending term (number of days) as Premium Charge Rate.

Premium Charge Rate = Premium Charge x lending term (number of days)

Premium Charge Rate shall not be incurred when additional LMT applications submitted on next business day eliminate the over lent situation. In such case, JSF publishes the Premium Charge as “*****”.

Meanwhile, when necessary amount is procured by the bidding and zero becomes the highest bidding rate of such over lent issue, JSF announces the Premium Charge as “0.00”

Meanwhile, when necessary amount is procured by the bidding and zero becomes the highest bidding rate of such over lent issue, JSF announces the Premium Charge as “0.00”

Lending Term Calculation

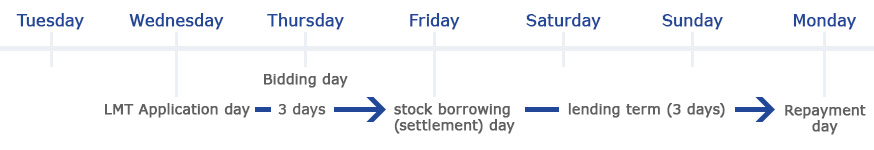

On the 3rd business day starting from LMT application day (on the 2nd business day starting from bidding day), JSF borrows stocks which JSF procures through bidding. JSF basically returns such issue on the next business day. In this case, lending term (the number of days that JSF borrows stock) is 1 day.

If the next day (repayment day) falls on holiday, lending term is extended in response to the number of holidays.

If the next day (repayment day) falls on holiday, lending term is extended in response to the number of holidays.

Example of 3 days lending term

Maximum Premium Charge

Premium Charge is obtained through the procedure of the stock procurement through bidding. In this procedure, the upper limit is set for the bidding price of each issue. This limit is referred to as the Maximum Premium Charge and is set in advance in corresponding to Investment unit calculated by multiplying trading unit and the margin loan price (JSF adopts for LMT cash and/or stock loan, and basically the closing price of regular session in stock exchanges).

Some Maximum Premium Charge calculation rules are different for stocks and for ETF etc.

If issues meet one of the conditions below, JSF organizes stock procurement through bidding while raising Maximum Premium Charge up to the level to be calculated by multiplying Maximum Premium Charge and integer multiples indicated correspondingly to each condition.

| Conditions | Integral multiples | Applied period |

| (1) Issues with record dates (set for dividends or rights) | Maximum Premium Charge: 2 times as high as usual upper limit |

For applications submitted between 6 and 2 business days prior to the ex-dividend/ex-rights date |

| (2) Issues with record dates (set for dividends or rights) | Maximum Premium Charge : 4 times as high as usual upper limit | For applications submitted on the day before the ex-dividend/ ex-rights date |

| (3)Issues for which precaution on the use of stock loan is announced | Maximum Premium Charge : 2 times as high as usual upper limit | For applications from the following day after such notice is issued until the previous day on such notice is cancelled |

| (4)Issues for which restriction or suspension of stock lending applications is announced | Maximum Premium Charge : 2 times as high as usual upper limit | Applied from the following day after such restriction or suspension is announced until the previous day on such restriction/ suspension is cancelled |

| Issues which meet (1) and ((3) or (4)) | Maximum Premium Charge : 4 times as high as usual upper limit | For applications submitted between 6 and 2 business days prior to the ex-dividend/ex- rights date |

| Issues which meet (2) and ((3) or (4)) | Maximum Premium Charge : 8 times as high as usual upper limit | For applications submitted on the day before the ex-dividend/ ex-rights date |

| If there is, or might be, an unusual stock over-lent situation, due to drastic changes in stock markets or to a shortage of stocks | Maximum Premium Charge : 4 times as high as usual upper limit | Applied from the following day after such restriction or suspension is announced until the previous day on such restriction/ suspension is cancelled |

| If there is, or might be, an extremely unusual stock over-lent situation, or there might be settlement trouble due to difficulties in procuring stocks to be lent in the stock market | Maximum Premium Charge : 10 times as high as usual upper limit | Applied from the following day after such restriction or suspension is announced until the previous day on such restriction/ suspension is cancelled |